Electronic Banking for Dynamics 365

Electronic Banking for Dynamics 365 allows you to communicate with your bank and automatically process payments

Supported Countries

Canada, United States and Germany

Last Updated

January 16, 2026

Implementation Cost

$0

Features

Are you still manually loading files into your online banking? Or worse, manually replicating transactions between your bank and ERP?

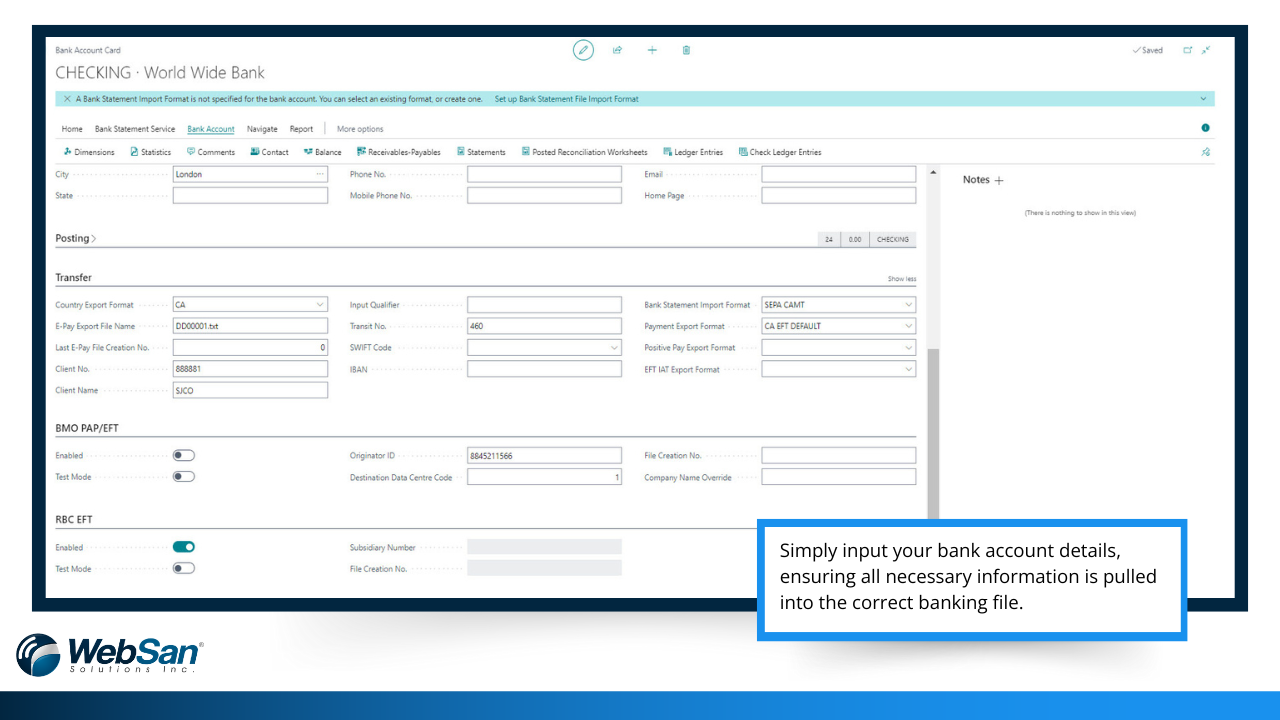

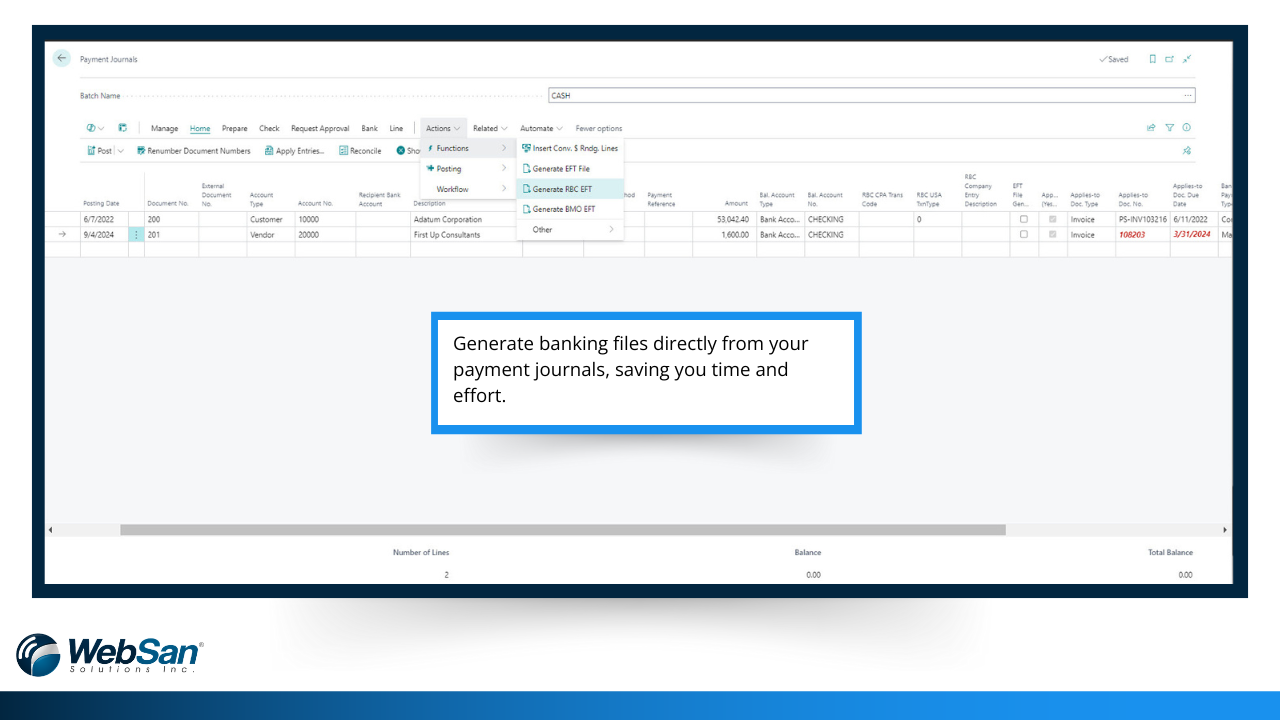

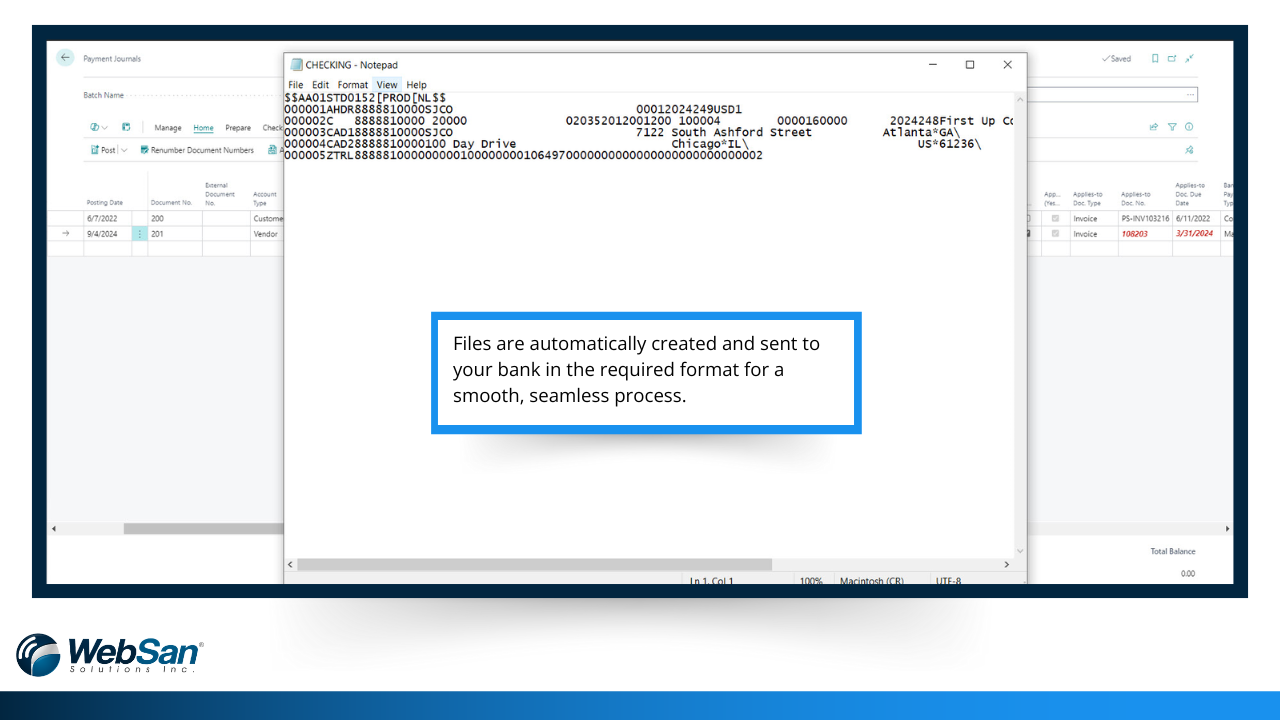

This app is an out-of-the-box bank data integration tool that allows Microsoft Dynamics 365 Business Central to communicate with your bank and mass process payments. With its intuitive interface, you can export payment files with the data and format required by your bank to process with ease.

Benefits Include:

- Simple to use: Easily generate payment files for your bank in Business Central

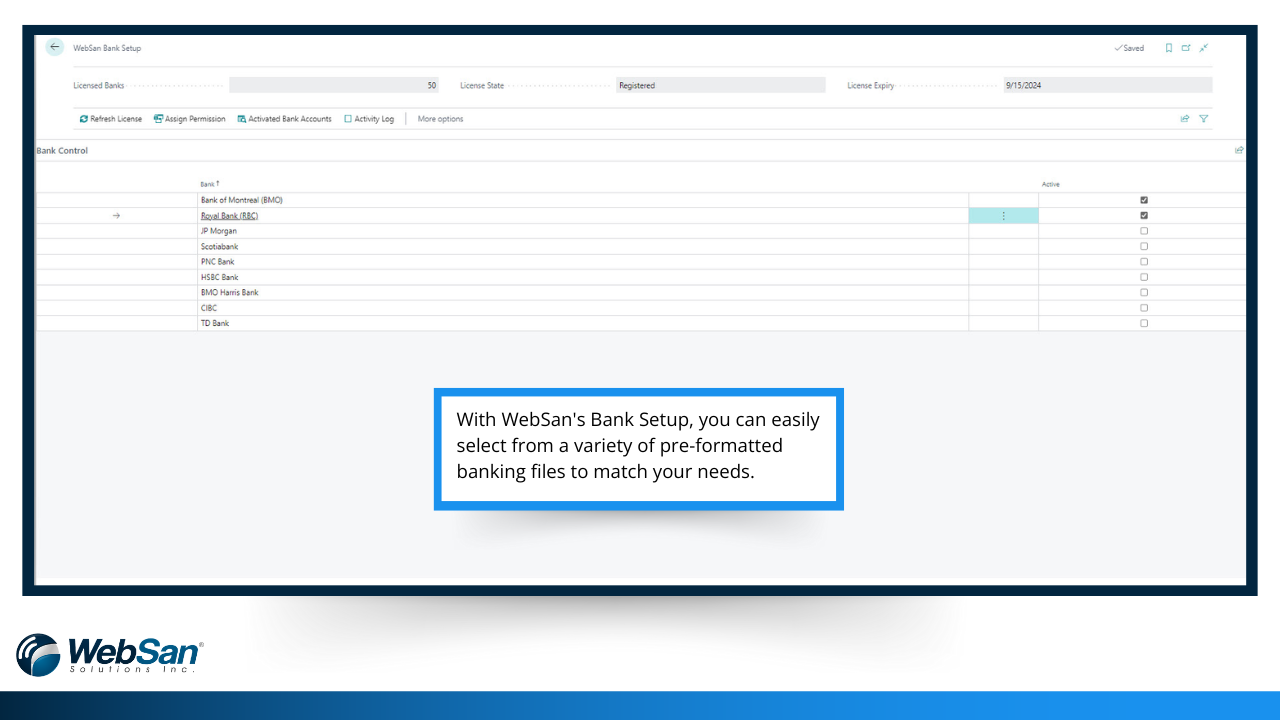

- Versatility: Multiple banking formats are supported

- Peace of Mind: We will set up any bank-specific format and handle any updates or maintenance

- Reduced Error: You never have to worry about the files containing any problems caused by user error

- Practical: Automatically generate remittance documents

Supported Banks: TD Bank, RBC, CIBC, Scotiabank, BMO (& BMO Harris), HSBC (& HSBC Bermuda), JP Morgan, PNC, First Republic, First Citizen, Wintrust, Washington Trust, Nicolet National, Truist, Butterfield, and more!

Start your free trial today!

Benefits

-

Eliminating information irregularities

-

Creating a flow of communication between different departments

-

Getting more operational control of your business

Supported Languages

English and French.

Whitepaper

Revolutionizing Financial Operations with Electronic Banking for Dynamics 365

Streamline your financial operations and eliminate the inefficiencies of manual banking processes with Electronic Banking for Dynamics 365. This powerful app connects Microsoft Dynamics 365 Business Central directly to your banking ecosystem, enabling automated payment processing, reducing errors, and simplifying remittance generation. Supporting multiple banking formats and requiring no maintenance for updates, this seamless solution enhances productivity, ensures accuracy, and adapts effortlessly to various financial institutions. Download the whitepaper to discover how to revolutionize your financial workflows and boost efficiency in today’s demanding business landscape.

Release Notes:

25.10.263.0 - September 2, 2025

-

Added integration points for RBC

25.11.271.0 - September 5, 2025

-

Routine maintenance for improved system reliability

25.12.275.0

-

Added Washington Trust Bank

25.13.286.0 - October 1, 2025

-

Added Trusit Bank (US)

25.16.293.0

-

Nicolet National Bank - ACH

25.17.295.0

-

Nicolet National Bank - ACH Updates

25.18.297.0 - November 21, 2025

-

Backend system updates

25.20.301.0

-

Wintrust Bank ACH (EN only)