Mastering Manufacturing in Business Central: Understanding Standard vs. Actual Costs in Business Central

Understanding Standard vs. Actual Costs in Business Central

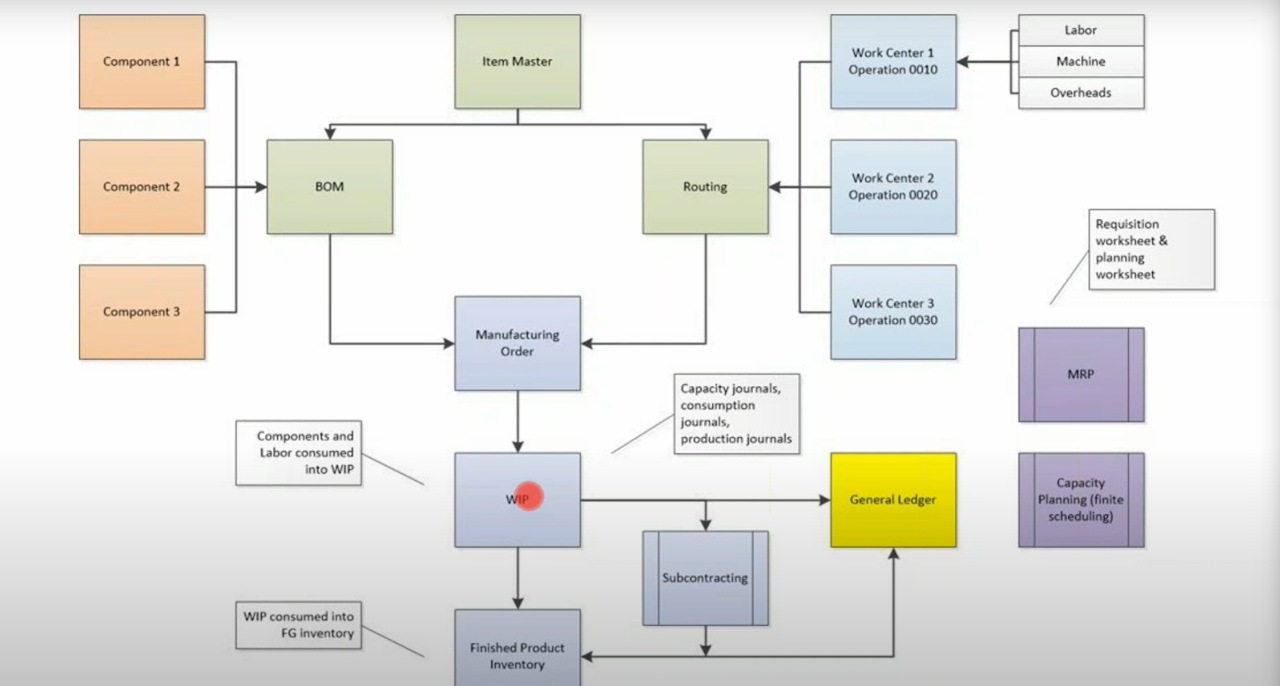

When it comes to manufacturing in Microsoft Dynamics 365 Business Central, one of the most important and most misunderstood topics is costing. It's not just a behind-the-scenes accounting detail. Your costing method affects inventory valuation, profitability, and how you make decisions on pricing and efficiency. In this blog, we'll break down the key costing methods in Business Central and focus on the two most widely used: Standard Costing and FIFO (Actual) Costing.

Why Costing Matters

Costing is where everything in manufacturing ties together: BOMs, routings, labour, overheads, and production efficiency. Business Central gives you visibility into:

- Cost of Goods Sold (COGS)

- Inventory valuation accuracy

- Production variances that impact profitability

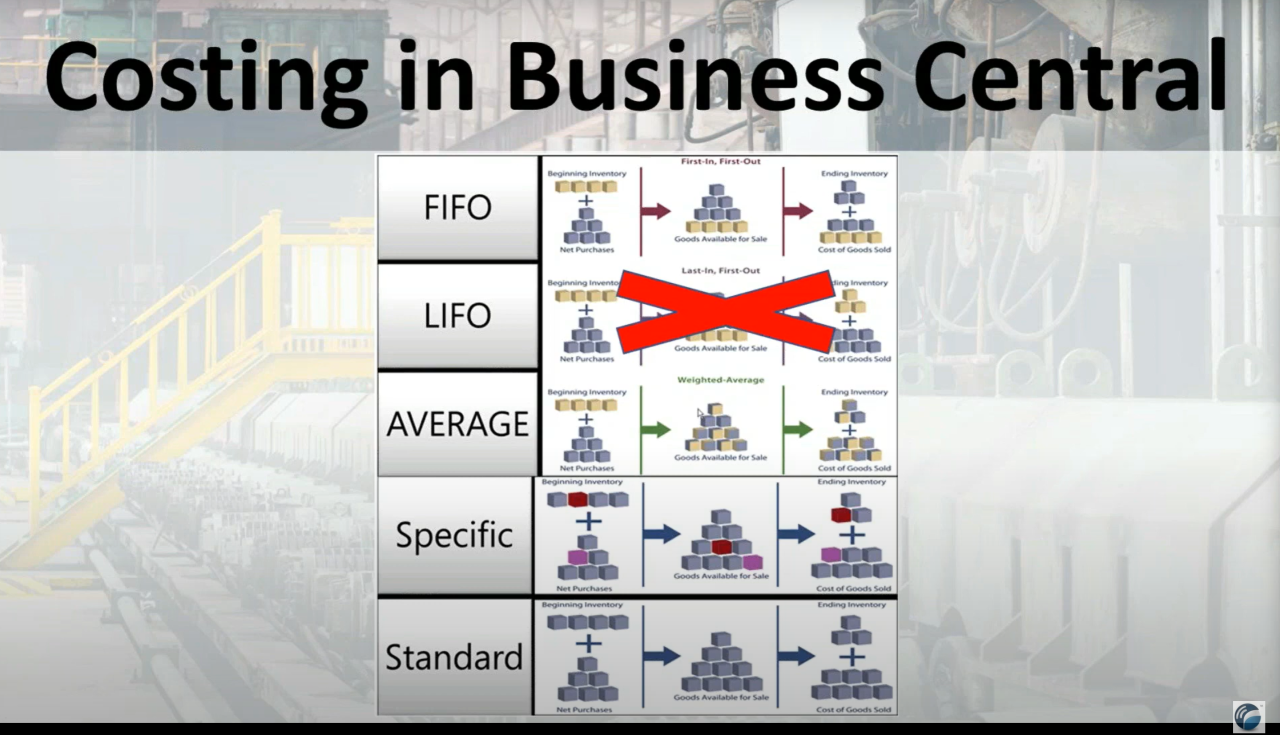

The 5 Costing Methods in Business Central

Business Central supports five costing methods, but only four are typically used in manufacturing:

- FIFO (First In, First Out) – Uses actual historical purchase/production costs. Simple and accurate for fluctuating material prices.

- Specific Costing – Tracks cost by lot or serial number. Useful in regulated industries like food or pharmaceuticals.

- Average Costing – Calculates a weighted average. Helpful when pricing is relatively stable and item traceability isn't critical.

- Standard Costing – Assigns a fixed cost to each item. Powerful for variance tracking and financial control in mature manufacturing environments.

- LIFO – Rarely used due to accounting standards and is not typically supported.

Standard Costing vs. FIFO: What's the Difference?

| Feature | FIFO (Actual Costing) | Standard Costing |

| Inventory Value | Based on actual cost | Fixed, predefined standard cost |

| Variance Tracking | No formal tracking | Detailed GL--level variance tracking |

| GL Entry Detail | High-level | Itemized and auditable |

| Best for | Fluctuating material costs | Stable, repetitive production |

When Should You Use Each?

- Use FIFO if you're just starting out, or if your raw material costs fluctuate often.

- Use Standard Costing if your manufacturing process is mature, repetitive, and stable—especially if variance tracking is a top priority.

The choice ultimately depends on how well you know your true costs and how much visibility you need.

Coming Up Next

In the next blog, we'll take you inside Business Central to show how these costing methods work in action. We'll walk through a real-world example of producing an item with standard cost, show you the resulting general ledger entries, and compare it to FIFO so you can see the difference for yourself.

Have questions about costing in your own Business Central environment? Contact WebSan Solutions to speak with an expert.